Written by Katy J.

Introduction

H&M is a global brand that presently operates in more than 60 countries (H&M, 2019b). The unique element of its internationalisation strategy is the use of diverse market entry modes. While its physical stores usually operate as directly owned subsidiaries, it also maintains an online presence in more than 30 countries allowing customers to receive their orders via franchisees (H&M, 2019c). These entry modes are usually applied in some developing markets including Egypt, India, Indonesia, and Thailand where the traditional company business model cannot be realised due to regulatory barriers or high levels of investment risks (H&M, 2019d). The aim of this report is to perform a strategic marketing analysis of potential H&M expansion into India.

Country Background

India was one of the countries planned by H&M for online expansion in 2019 (Mulier and Hoikkala, 2019). However, decreasing global profitability forced the company to cancel some of its internationalisation plans. Hence, now is the optimal moment to revise the lucrativeness of this market one more time and reconsider the available entry options in terms of their associated cost economies. The PESTLE framework allows marketers to explore the political, economic, social, technological, legal, and environmental situation in the selected environment (West et al., 2015).

Political

The country has recently re-elected its prime minister who is supported by the vast majority of citizens, which provides for good political stability (Burke, 2019). However, the government has recently initiated multiple swift actions such as the change of the Kashmir region special status. This indicates the overall readiness for major policy changes that may affect foreign companies entering this market (Cid and Baum, 2019).

Economic

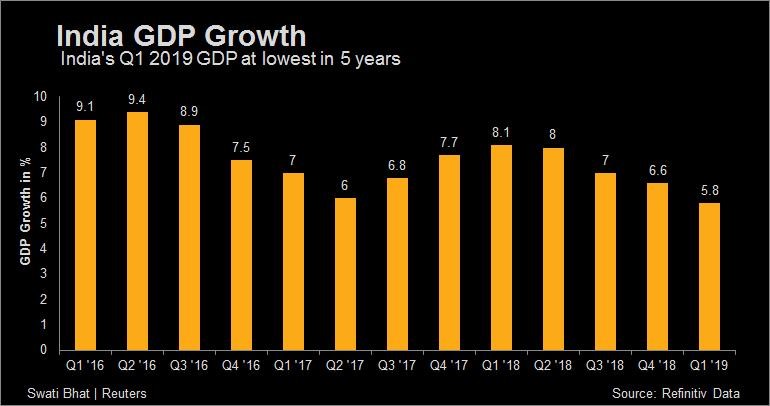

The GDP of India has been steadily decreasing from the beginning of 2018 despite the multiple reforms initiated by the government (Roy and Ulmer, 2019). In this situation, the regulators may be willing to take harsh measures such as the introduction of stronger protectionist policies to support local businesses Cid and Baum, 2019). This may be dangerous for H&M in the case of a large-scale entry with substantial investments.

Figure 1: India GDP Growth

Source: Roy and Ulmer (2019, p.1)

Social

Indian society is characterised by high degrees of collectivism and hedonism, which stimulates many buyers to demonstrate their social status through expensive purchases (Hariramani, 2017). The growing demand for fashion products may be lucrative for H&M as a provider of reasonably priced fashion items within the scope of the current economic problems and shrinking purchasing capacity of Indian customers (Roy and Ulmer, 2019).

Technological

India has one of the highest technological growth rates, which may be highly attractive for both online and offline sales (Ghosh and Sur, 2015). The increasing availability of IT connectivity in the country rural areas gives thousands of customers access to the offerings they could not access previously, which reflects a gigantic marketing potential for fast fashion companies (Cid and Baum, 2019).

Legal

The country has high degrees of non-transparency in terms of business regulations (Sheldon et al., 2018). It implements largely protectionist policies while also demanding the local storage of all financial data from foreign companies, which is associated with substantially higher costs and the risks of corruption (Cid and Baum, 2019).

Environmental

The complex environmental situation in India can make it difficult to produce some textile items locally, which suggests that these goods will need to be imported (Chandra, 2015).

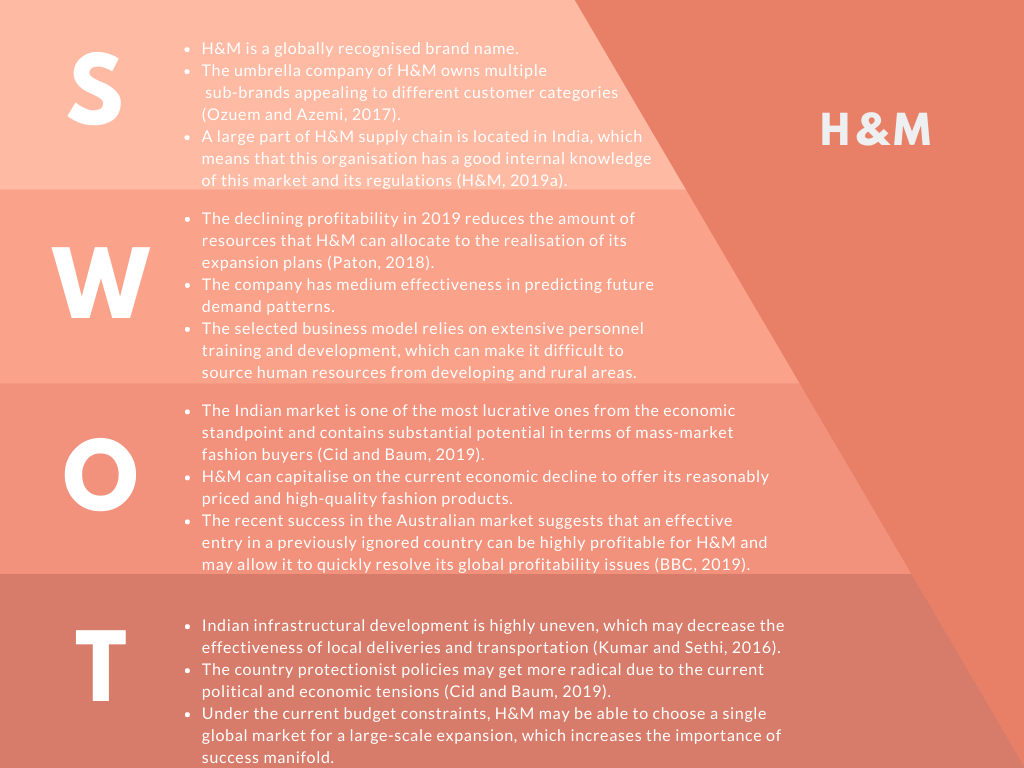

Company Background

First, it is necessary to explore the company situation at the moment to identify its resources, weak points, and strategic options. A SWOT analysis explores these factors within the scope of four primary dimensions, namely strengths, weaknesses, opportunities, and threats (Fleisher and Bensoussan, 2015).

Figure 2: SWOT Analysis

Competitive Environment

The Porter’s Five Forces framework allows marketers to appraise the competitive situation in a particular market by studying the bargaining power of suppliers, the threat of new entrants, the bargaining power of customers, the threat of substitutes, and the overall degree of competitive rivalry (Yeomans and Rogers, 2017).

Bargaining Power of Suppliers – High

H&M is highly dependent on its diversified supply chain and any disruptions in it can have a major impact on its global sales (Ozuem and Azemi, 2017).

Threat of New Entrants – Medium

The country market is already populated by some international fast fashion brands including Zara as well as the local brands from the Tata Group (BBC, 2019). The regulatory barriers also make a full-scale entry a costly investment.

Bargaining Power of Customers – High

The growing average income means that Indian customers are free to choose from a variety of offerings in this sphere (Hariramani, 2017). This is addressed by local mall chains such as Myntra that prefer to promote multiple fashion brands (Cid and Baum, 2019).

Threat of Substitutes – Medium

H&M has unique and recognisable fashion designs due to its long industry expertise and cooperation with famous experts (Ozuem and Azemi, 2017). However, consumers can still choose competing offerings due to better pricing or their personal preferences in apparel products and accessories.

Competitive Rivalry – High

The overall level of rivalry can be appraised as high since there exist multiple local and international organisations focused on the same market segment (BBC, 2019). Most of them possess sufficient resources and already have years of experience in this country, which may increase the risks for H&M.

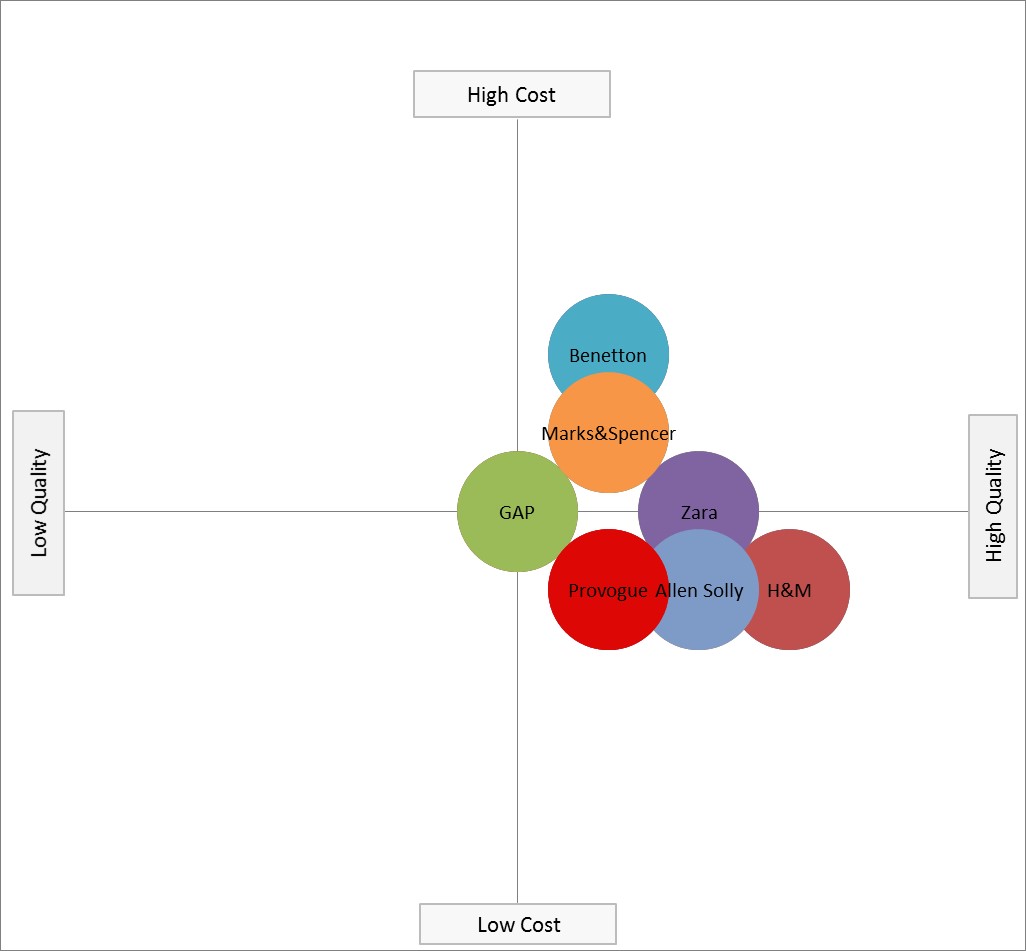

Local Competition

The primary international rivals of H&M in India include Benetton, GAP, Marks&Spencer, and Zara (BBC, 2019). The first two companies have been present in this market since the late 1990s, which makes them more experienced. At the same time, such local brands as Allen Solly by Madura Fashion & Lifestyle and the Mumbai-based Provogue are supported by some of the largest Indian fashion and lifestyle corporations (Cid and Baum, 2019). Additionally, they do not experience the regulatory pressure from protectionist import and foreign investment policies imposed upon western companies.

Figure 3: Local Competitors Map

Competitive Strategies and Market Entry Strategies

The key competitive strategy of H&M in the global market can be characterised as a combination of cost leadership and the elements of differentiation (Varley et al., 2018). The fast-fashion business model of the company is built upon the outsourcing of new designs to multiple independent suppliers. These companies manufacture small batches of H&M products throughout the year, which allows this brand to quickly present the apparel collections reflecting the latest fashion trends. There exist multiple market entry modes offering different degrees of control over the local operations and the overall financial engagement in them (Phillips and Moutinho, 2018). It can be suggested that direct and indirect exporting may not be suitable for H&M since this company primarily operates via mono-brand stores, which makes its business model incompatible with multi-brand distribution (H&M, 2018). Similarly, the studied organisation cannot license the production of its apparel and lifestyle items to local manufacturers.

The recent expansion plans in Europe and the Middle East primarily rely on the franchising option where local representatives pay loyalties to the main brand and open branded stores under its supervision (H&M, 2018). This model minimises investment requirements and political risks while providing a medium degree of control over local operations due to the complexity of operational monitoring and compliance control. While the company generally discards this option in its global expansion strategy (HMGroup, 2019), this choice may be more suitable for H&M than wholly-owned subsidiaries due to a number of reasons. First, the protectionist policies of the Indian government can increase the risks of ‘sunk costs’ in the case of direct foreign investments (Cid and Baum, 2019). Second, the decreasing profits of the company significantly reduce its capability to realise a large-scale market entry strategy in the case of full ownership (Paton, 2018).

The possessed experience of operating in the country also relates to supply chain management rather than marketing, which raises further questions regarding the capability to successfully launch the brand in India without local assistance (Cid and Baum, 2019). It should be noted that joint venture agreements and strategic partnerships may be another viable alternative for H&M. The long-term experience of collaboration between H&M and famous fashion designers suggests that the company could successfully realise a similar scheme in India (Varley et al., 2018). This country has a number of powerful fashion brands as well as the designers utilising national motives, materials, and traditional concepts (Kamath, 2018). This could allow H&M to co-develop a line of products aimed at Indian consumers using the expertise and insights of its local partners to minimise its entry risks.

Post-Entry Expectations

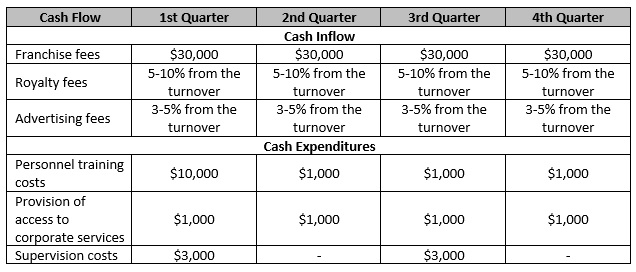

Since H&M does not broadly support franchising agreements, the approximate figures have been taken from the open sources exploring the franchise costs of similar companies such as Zara (Ballay, 2018). Cash expenditures include the services that are usually provided to franchisees (Varley et al., 2018).

Table 1: Projected Cash Flow

Conclusion

It can be summarised that the potential entry of H&M to the Indian market may be characterised by a medium degree of associated threats. On the one hand, the company has internal weaknesses such as declining revenues that limit its risk tolerance levels and suggests a highly cautious approach to foreign direct investments (Yeomans and Rogers, 2017). On the other hand, the studied market has a number of political and regulatory threats that may result in protectionist policies decreasing the competitiveness of global fashion brands in India (Sheldon et al., 2018). At the same time, this country has an increasing demand for reasonably priced lifestyle and apparel products (Cid and Baum, 2019). It is supported by the advancement of technological connectivity and the eagerness of consumers to demonstrate their high social status through wearable items showing off their unique lifestyle (Hariramani, 2017). These factors suggest that the franchising market entry strategy may be the most optimal one for H&M at the moment. First, this approach is cost-efficient and minimises potential sunk costs in the case of a worst-case scenario, which is convenient considering the limited corporate budgets (Phillips and Moutinho, 2018). Second, it relies on the competencies of local partners who use their expertise to develop the presence of H&M in India. Finally, the company can still enter this market in the future after establishing a foothold by realising the more traditional scheme of wholly-owned subsidiaries.

References

Ballay, R. (2018) “Zara posts 73% surge in India net for FY18”, [online] Available at: https://economictimes.indiatimes.com/industry/cons-products/fashion-/-cosmetics-/-jewellery/zara-posts-73-surge-in-india-net-for-fy18/articleshow/64892126.cms [Accessed on 24 October 2019].

BBC (2019) “Australian retail: Why so many fashion brands have collapsed”, [online] Available at: https://www.bbc.com/news/world-australia-47450073 [Accessed on 24 October 2019].

Burke, J. (2019) “India’s cancellation of Kashmir’s special status will have consequences”, [online] Available at: https://www.theguardian.com/world/2019/aug/05/india-cancellation-of-kashmir-special-status-will-have-consequences [Accessed on 24 October 2019].

Chandra, M. (2015) “Environmental Concerns in India: Problems and Solutions”, Journal of International Business and Law, 15 (1), pp. 1-15.

Cid, J. and Baum, L. (2019) Doing Business in India, London: LID Publishing.

Fleisher, C. and Bensoussan, B. (2015) Business and competitive analysis: effective application of new and classic methods, New York: FT Press.

Ghosh, B. and Sur, D. (2015) “The Impact of Globalization on India's Technology Regime: A Quantitative Exploration of India's Organized Manufacturing Industries”, IUP Journal of Applied Economics, 14 (2), pp. 7-23.

H&M (2018) “H&M Group Annual Report 2018”, [online] Available at: https://about.hm.com/content/dam/hmgroup/groupsite/documents/masterlanguage/Annual%20Report/Annual%20Report%202018.pdf [Accessed on 24 October 2019].

H&M (2019a) “Supplier List”, [online] Available at: https://sustainability.hm.com/en/sustainability/downloads-resources/resources/supplier-list.html [Accessed on 23 October 2019].

H&M (2019b) “Full-Year Report”, [online] Available at: https://about.hm.com/content/dam/hmgroup/groupsite/documents/masterlanguage/cision/2019/01/2371044.pdf [Accessed on 24 October 2019].

H&M (2019c) “The H&M group reaches customers around the world”, [online] Available at: https://about.hm.com/content/dam/hmgroup/groupsite/documents/en/Digital%20Annual%20Report/2017/Annual%20Report%202017%20Customers%20the%20world%20around.pdf [Accessed on 24 October 2019].

H&M (2019d) “Markets and Expansion”, [online] Available at: https://hmgroup.com/about-us/markets-and-expansion.html [Accessed on 24 October 2019].

Hariramani, S. (2017) “Buying Behaviour and Perceptions Regarding Branded vs Unbranded Lifestyle Products”, Open Access Journal of Social Services, 1 (2), pp. 5-14.

HMGroup (2019) “Market Overview”, [online] Available at: https://hmgroup.com/about-us/markets-and-expansion/market-overview.html [Accessed on 24 October 2019].

Kamath, A. (2018) “Meet 12 expat fashion designers who have made India their home”, [online] Available at: https://www.vogue.in/magazine-story/meet-12-expat-fashion-designers-who-have-made-india-their-home/ [Accessed on 24 October 2019].

Kumar, R. and Sethi, A. (2016) Doing Business in India, Berlin: Springer.

Mulier, T. and Hoikkala, H. (2019) “H&M Gains as Retailer Shows Early Progress Toward Turnaround”, [online] Available at: https://www.bloomberg.com/news/articles/2019-06-27/h-m-cuts-expansion-plan-as-earnings-drop-for-eighth-quarter [Accessed on 23 October 2019].

Ozuem, W. and Azemi, Y. (2017) Digital Marketing Strategies for Fashion and Luxury Brands, Hershey: IGI Global.

Paton, E. (2018) “H&M, a Fashion Giant, Has a Problem: $4.3 Billion in Unsold Clothes”, [online] Available at: https://www.nytimes.com/2018/03/27/business/hm-clothes-stock-sales.html [Accessed on 24 October 2019].

Phillips, P. and Moutinho, L. (2018) Contemporary issues in strategic management, London: Routledge.

Roy, A. and Ulmer, A. (2019) “India Inc grows impatient as economy dips and Modi is distracted”, [online] Available at: https://www.reuters.com/article/us-india-economy-sentiment/india-inc-grows-impatient-as-economy-dips-and-modi-is-distracted-idUSKCN1VD0KM [Accessed on 23 October 2019].

Sheldon, I., Chow, D. and McGuire, W. (2018) “Trade Liberalization and Constraints on Moves to Protectionism: Multilateralism vs. Regionalism”, American Journal of Agricultural Economics, 100 (5), pp. 1375-1390.

Varley, R., Roncha, A., Radclyffe-Thomas, N. and Gee, L. (2018) Fashion Management: A Strategic Approach, London: Macmillan.

West, D., Ford, J. and Ibrahim, E. (2015) Strategic Marketing: Creating Competitive Advantage, Oxford: Oxford University Press.

Yeomans, D. and Rogers, P. (2017) Project Management Made Simple and Effective, Indianopolis: Dog Ear Publishing.