Written by Josh A.

Introduction

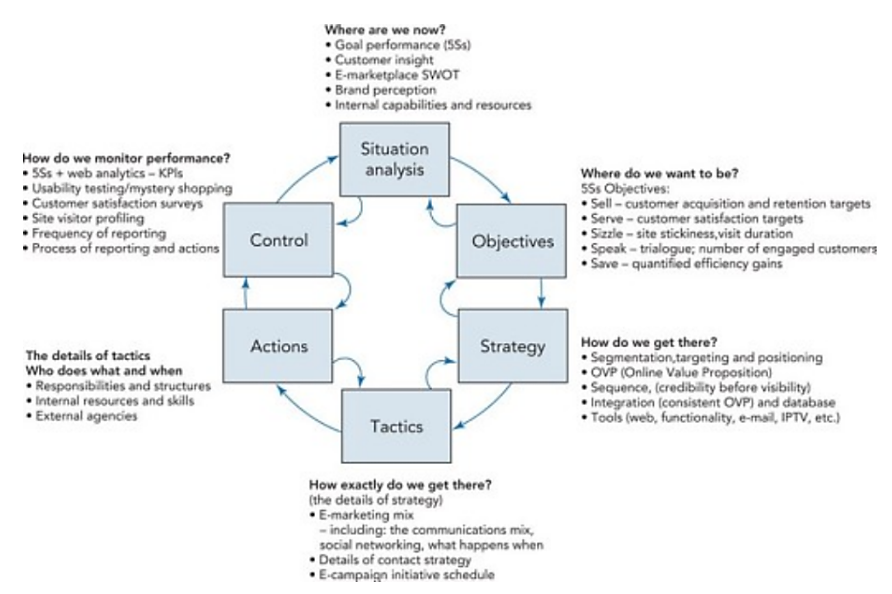

The market situation in the modern environment is changing quickly due to disruptive innovation trends, the entry of new market players, and the development of new communication technologies, which forces most companies to revise their marketing plans more often than before (Bolton et al., 2019). This activity is characterised by increasing complexity because decision-makers need to account for multiple factors including the available resources, the competence of existing staff members, the unique ways of creating customer value, and the targeting decisions defining the scope and focus of future campaigns. The SOSTAC® framework successfully addresses most of these elements by providing a solid foundation for building a comprehensive marketing strategy progressing from situation appraisals to implementation tactics and monitoring measures (Smith, 2022). This report explores the expansion of Monzo to the US market and provides a SOSTAC® plan for this company aimed at addressing the key challenges of this internationalisation move.

Company Background

Monzo is a UK-based mobile-only bank that was one of the pioneers of digital banking in this country (Carey, 2018). It presently has more than 1 million customers and a generally positive reputation based on its high perceived security, a wide range of services, and its strategic partnerships with other technological start-ups providing additional services to its cardholders free of charge or at a discounted price (Cook, 2019). While the company enjoys a substantial success in the UK market, it is presently considering an expansion in the United States by offering its debit cards to US consumers in several major cities.

SOSTAC® Planning

The SOSTAC® planning framework is widely used by specialists to develop effective marketing plans (Smith, 2022). It offers a comprehensive solution starting with a situation analysis to identify where the company is right now followed by the development of objectives outlining where it seeks to get to. Afterwards, the marketer develops specific strategies, tactics, and actions necessary to achieve these goals. The unique element of this model is its sixth dimension determining the control measures critical for measuring and monitoring the resulting performance to quickly identify any deviations from the plan or areas of inefficiencies (Safanta et al., 2019). The following sub-sections outline each of these dimensions for the Monzo organisation.

Figure 1: The SOSTAC® Framework

Source: Smith, PR (2022) The SOSTAC® Guide to your Perfect Digital Marketing Plan (2022)

Situation Analysis

Goal Performance

The initial scope of Monzo expansion in the US is limited to the distribution of several thousands of debit cards to live events visitors in several major cities (Monzo, 2019). This suggests that the company primarily seeks to gain foothold in this market and gradually build its reputation among US customers (Warren, 2019). The following objectives may be formulated for this purpose:

- Distribute the first 10,000 cards by March 2020.

- Increase the number of followers from the US region by 5,000 users for its Facebook page and by 5,000 users for its Instagram page.

- Increase online recognition by getting at least 10 positive reviews from independent opinion leaders from the US.

Customer Insight

The US banking industry is less advanced than the UK one from the technological standpoint as only 3% of all cards are contactless and many banks fail to provide the fully online banking experience (Warren, 2019). According to a recent report from Accenture (2019), the share of tech-savvy consumers seeking innovation reached 21% making this country one of the leaders in openness to financial services innovation. This can create a perfect ‘window of opportunity’ for Monzo as a digital-native bank.

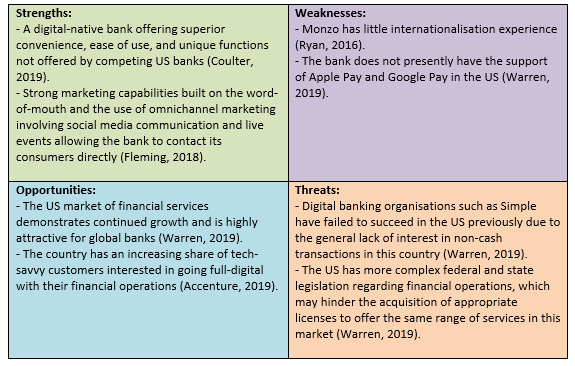

Marketplace SWOT

Table 1: Marketplace SWOT

Internal Capabilities and Resources

Monzo has a unique corporate culture based on the concept of absolute transparency (Monzo, 2019). This practice is evident in both the public discussions of company achievements and mistakes and the internal practices supporting information-sharing, whistleblowing, and audit results disclosure. In combination with the digital competencies, this creates valuable internal capabilities providing for a high degree of compliance with state regulations, which may be beneficial for the stricter US market (Fleming, 2018). Additionally, the 1+ million of UK users and sufficient financial resources gained through external investments and crowdfunding campaigns allow Monzo to launch medium- or large-scale promotional campaigns in the US in order to support its expansion into this market.

Objectives

Sell

The scope of initial expansion should be set to 10,000+ debit cards distributed before March 2020 and $100,000 worth of transactions performed by the end of 2020.

Serve

In terms of quality, the company needs to get 100+ positive reviews from the consumers satisfied with the promptness and convenience of the rendered financial services in the US within the first 6 months following its entry.

Sizzle

The company should get 5,000 new followers from the US for its Facebook page and 5,000 new followers from the US for its Instagram page.

Speak

New publications posted on the aforementioned social media pages must be liked or reposted by 100+ individuals from the US on the average within the first 6 months following the market entry.

Save

The preference for online promotion also produces substantial savings in terms of advertising costs.

Strategy

Segmentation, Targeting, and Positioning (STP)

From the segmentation standpoint, Monzo is interested in several categories of users. First, its offering is highly appealing to tech-savvy and innovative customers seeking a fully online banking experience (Coulter et al., 2019). Second, its lower servicing costs and partnerships with money transfer and insurance services providers make it lucrative for the persons interested in costs optimisation (Weiss, 2019). These factors suggest that online targeting may be more effective for reaching these two segments since both of these categories are actively using online platforms to search for new information and monitor interesting technological and financial trends. In terms of positioning, Monzo removes the psychological borderlines between its customers and the brand by maintaining full transparency in the discussion of its own flaws (Carey, 2018). It went as far as allowing consumers to choose a new name for the company in 2016 (Monzo, 2016). This approach may be seen as a unique and highly provocative one in the traditional banking industry relying on separation from the users and the image based on concealment of problems. The bold and straightforward positioning of Monzo should be retained in the US market as one of the key differentiating elements of its brand identity.

Online Value Proposition

It can be suggested that the online value proposition of Monzo should emphasise such qualities as functionality, cost advantages, security, and overall transparency (Ryan, 2016). As opposed to traditional banks, this organisation can work with its consumers directly to assist them in reaching their financial goals (Burgess, 2019).

Integration

The integration of the aforementioned elements should be performed via the demonstration of both the brand and its ideal customer image in all advertising materials and blog posts (Kennada, 2019).

Tools

Specific tools for promoting Monzo to US consumers may include social media marketing, context advertisements, and live events (Ryan, 2016). The three primary communication platforms should be the corporate website, the official Instagram page, and the official Facebook page. Considering the focus on direct customer engagement, official YouTube videos or traditional advertising may be less effective and should be omitted during the first months of the campaign (Kennada, 2019).

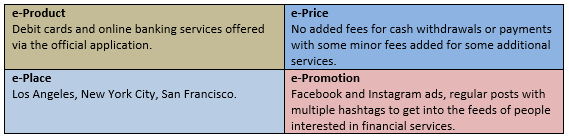

Tactics (E-Marketing Mix)

Table 2: E-Marketing Mix

Actions

According to Sokowski (2015), all objectives must be SMART (specific, measurable, actionable, realistic, and time-bound).

Social Media Marketing

For the Facebook campaign, Monzo should focus on publishing posts about ‘financial literacy’ and the ways to cut costs and increase customer convenience through the use of online banking (Weiss, 2019). These posts should not be associated with sales activities directly but may include links to the corporate website, products, or blog publications. For Instagram marketing, the company should utilise the same approach realised in the UK and focus on the promotion of user experiences, lifestyle recommendations, and user-generated content rather than advertising materials. This will allow the bank to fully utilise the visual appeal of this platform and lead consumers into adding #Monzo tags to their personal publications to increase the overall marketing reach (Patel, 2019a).

Contests and Engagement Campaigns

The previous recommendation should lead to several online contests based on both hashtagged visual content and textual ideas (Patel, 2019b). The company should offer valuable prizes for offering Monzo-inspired photos on Instagram and cost optimisation ideas in Facebook comments. This way, it can appeal to both earlier identified customer segments more effectively (Kennada, 2019).

Live Events

Finally, the company needs to organise several live events in each of the three targeted cities to promote its products, increase its market exposure, and build customer trust through direct communication and experiential marketing (Kennada, 2019). The promotion of these meetings should be performed in accordance with the earlier performed customer profiling and focus on younger and tech-savvy audiences (Ryan, 2016). It may be possible to partner with technology exhibitions and other innovative events to capitalise on the overall concept of innovativeness and advanced consumer experience.

Control

The three utilised marketing strategies must be closely controlled in terms of their intermediary and final outcomes. In the case of social media marketing, Monzo needs to track several performance indicators, namely the number of likes and reposts, the number of comments, the number of brand references, and the number of leads produced by individual campaign activities (Ryan, 2016). Additionally, the company should monitor consumer proactivity, namely the intention to proactively establish communication on social media to learn more about the offered products and services. In addition to the above-mentioned measures, Monzo should control the signs of consumer dissatisfaction that frequently occurs during various online lotteries and contests (Hanlon, 2019). It must ensure that the prize distribution is performed in a highly transparent manner and the winners are real persons ready to confirm the campaign fairness. In terms of live events, the company should focus on the resulting number of leads, the number of distributed debit cards, positive reviews in offline and online media, and the customer satisfaction expressed on various online platforms (Chaffey and Ellis-Chadwick, 2019). If some of these indicators are sub-optimal, it may be necessary to organise events in different cities or locations or discard this approach completely.

Conclusion

It can be summarised that Monzo has good prospects of success in the US market but needs to clearly demonstrate its advantages as a digital bank to the two selected customer segments (Hofacker, 2018). This effect can be achieved by building trust via social media engagement, live events, and various contests and campaigns (Kennada, 2019). If this initial launch in three cities proves successful, it may be possible to expand the reach to additional major locations depending on the results of geotargeting tracking and the number of search requests analysis for various US regions.

References

Accenture (2019) “2019 Accenture Global Financial Services Consumer Study”, [online] Available at: https://www.accenture.com/_acnmedia/pdf-95/accenture-2019-global-financial-services-consumer-study.pdf [Accessed on 18 October 2019].

Bolton, R., Chapman, R. and Mills, A. (2019) “Harnessing digital disruption with marketing simulations”, Journal of Marketing Education, 41 (1), pp. 15-31.

Burgess, M. (2019) “Two new Monzo features will help you save like a pro”, [online] Available at: https://www.wired.co.uk/article/monzo-salary-sorter [Accessed on 21 October 2019].

Carey, S. (2018) “How Monzo is rewriting the rulebook when reporting data breaches”, [online] Available at: https://www.computerworld.com/article/3427792/how-monzo-is-rewriting-the-rulebook-when-reporting-data-breaches.html [Accessed on 19 October 2019].

Chaffey, D. and Ellis-Chadwick, F. (2019) Digital Marketing, London: Pearson UK.

Cook, J. (2019) “Rise of the digital banks: Monzo and Revolut on track to treble customer numbers”, [online] Available at: https://www.telegraph.co.uk/technology/2019/09/03/rise-digital-banks-monzo-revolut-track-treble-customer-numbers/ [Accessed on 21 October 2019].

Coulter, M. (2019) “Monzo, Starling and Revolut hunt for older, more diverse, customers”, [online] Available at: https://www.ft.com/content/ca34eede-7587-11e9-bbad-7c18c0ea0201 [Accessed on 21 October 2019].

Fleming, M. (2018) “How Monzo’s ‘radical transparency’ approach is disrupting banking”, [online] Available at: https://www.marketingweek.com/monzo-marketing-innovation-disrupt-banking/ [Accessed on 18 October 2019].

Hanlon, A. (2019) Digital Marketing: Strategic Planning & Integration, London: SAGE.

Hofacker, C. (2018) Digital marketing: Communicating, Selling and Connecting, Hoboken: Edward Elgar Publishing.

Kennada, A. (2019) Category Creation: How to Build a Brand that Customers, Employees, and Investors Will Love, Hoboken: John Wiley & Sons.

Monzo (2016) “Mondo is now Monzo”, [online] Available at: https://monzo.com/blog/2016/08/25/monzo [Accessed on 19 October 2019].

Monzo (2019) “Annual Report 2019”, [online] Available at: https://monzo.com/static/docs/annual-report-2019.pdf [Accessed on 18 October 2019].

Patel, N. (2019a) “Hashtags Aren’t Gimmicks: How Buffer’s Twitter Chat Reached 49,993,695 People in One Year”, [online] Available at: https://neilpatel.com/blog/hashtags-arent-gimmicks/ [Accessed on 21 October 2019].

Patel, N. (2019b) “How to Use Contests and Giveaways to Get User-Generated Content”, [online] Available at: https://neilpatel.com/blog/contests-user-generated-content/ [Accessed on 21 October 2019].

Ryan, D. (2016) Understanding Digital Marketing: Marketing Strategies for Engaging the Digital Generation, London: Kogan Page Publishers.

Safanta, A., Shihab, M., Budi, N., Hastiadi, F. and Budi, I. (2019) “Digital Marketing Strategy for Laboratories Marketplace”, Journal of Physics: Conference Series, 1196 (1), pp. 1-9.

Smith, PR (2022) The SOSTAC® Guide to your Perfect Digital Marketing Plan (2022)

Sokowski, D. (2015) Mastering Project Management Integration and Scope: A Framework for Strategizing and Defining Project Objectives and Deliverables, New York: FT Press.

Warren, T. (2019) “Monzo launches its ‘bank of the future’ in the US”, [online] Available at: https://www.theverge.com/2019/6/13/18677298/monzo-bank-us-launch-date-availability [Accessed on 17 October 2019].

Weiss, S. (2019) “The best Monzo hacks and hidden features to make saving suck less”, [online] Available at: https://www.wired.co.uk/article/best-monzo-app-hidden-features [Accessed on 21 October 2019].