1. What is Cost Leadership?

Cost leadership is one of the four competitive strategies described by Michael Porter (Porter, 1985). It implies the use of economies of scale, advanced technologies, and extensive industry expertise to win over rivals by offering standardised products of superior quality at the lowest price possible. It has been adopted by such market leaders as Tesco in the UK and Walmart in the US for decades with highly positive results.

A full environmental analysis of Tesco with the implementation of PESTLE, SWOT, Porter’s Five Forces, and Value Chain frameworks is available here.

2. What Are the Main Implications of Cost Leadership for Budget Supermarkets?

One of the most obvious limitations of the studied strategy is the need to maintain consistently low prices and primarily rely on price-based competition (Islami et al., 2020). This may be highly problematic in some industries where rivals can import some products from or outsource some services to developing countries with extremely low labour costs. As also noted by Islami et al. (2020), the analysed strategy makes the companies using it vulnerable to sudden market changes such as political and economic climate disruptions or border closures and other factors affecting the functioning of supply and distribution chains. Additionally, the entry of new competitors frequently reduces profit margins as the brands using cost leadership have to keep their prices low to retain their customers (Alibeiki et al., 2020). The generic nature of their offerings also decreases consumer loyalty and consumer lock-in effects as buyers can easily switch to alternative mass-market offerings.

3. Did Tesco Discard Cost Leadership?

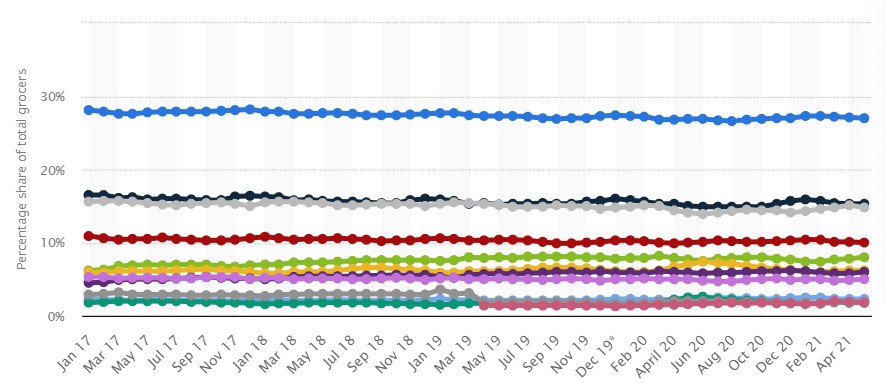

Cost leadership still forms a substantial part of the overall competitive strategy of Tesco with the company initiating multiple ‘price wars’ against its rivals in the 2010s (Kar et al., 2021). However, the following figure from Statista (2021) suggests that this approach may not be deemed sustainable due to the entry of multiple European rivals such as Aldi and Lidl into many regions of its presence. Since the UK market is physically limited due to its insular position, this reduces the available market share of the studied company and reduces its resources. To build a more sustainable competitive model, Tesco adopted many elements of differentiation as its second generic strategy (Kar et al., 2021). They are most visible at the level of its marketing mix and product mix where it introduced its Tesco Finest products to compete with Aldi Specially Selected and Lidl Deluxe offerings.

Figure 1: Shares of UK Grocery Chains (%)

Source: Statista (2021, n.p.)

These practices involve the creation of premium items in close collaboration with some renowned manufacturers willing to ‘ghost produce’ high-quality foods in large quantities for commercial gains (Kar et al., 2021). Effectively, Tesco serves as a distributor in this scenario by exchanging its financial assets, expertise, and economies of scale for increased brand power. The process is further supported by rebranding activities including a change of the logo and packaging for all Tesco Finest offerings. The new combined strategy may be seen as a more sustainable one since prospective consumers will associate the company with premium products while loyal clients may decide to experiment with these unique offerings, which increases company profits via new upselling opportunities (Islami et al., 2020).

References

Alibeiki, H., Li, S. and Vaidyanathan, R. (2020) “Market dominance or product cost advantage: Retail power impacts on assortment decisions”, International Journal of Production Economics, 222 (1), pp. 1-17.

Islami, X., Mustafa, N. and Latkovikj, M. (2020) “Linking Porter’s generic strategies to firm performance”, Future Business Journal, 6 (1), pp. 1-15.

Kar, S., Bansal, R. and Mishra, S. (2021) “Tesco: Entry and Expansion Strategy in India”, Emerging Economies Cases Journal, 1 (1), pp. 1-12.

Porter, M. (1985) Competitive Advantage, New York: Free Press.

Statista (2021) “Market share of grocery stores in Great Britain from January 2017 to May 2021”, [online] Available at: https://www.statista.com/statistics/280208/grocery-market-share-in-the-united-kingdom-uk/ [Accessed on 22 October 2021].