Written by Katy J.

1. Introduction

Corporate social responsibility (CSR) is widely considered an important form of a firm’s self-regulation, which has a significant effect on financial performance and corporate decisions on how much to invest into socially responsible programmes and activities (Lin et al., 2015, p.8292). Nevertheless, there has been a considerable debate among academics about the effect of CSR on companies and their stakeholders (Hur et al., 2014, p.84; Prutina, 2016, p.242; Nalband and Al Kelabi, 2014, p.237). The main purpose of this essay is to identify and critically discuss the impact of CSR on organisational stakeholders in the light of various theories, including the stakeholder theory and shareholder theory. The essay consists of an introduction, a critical review of the CSR concept, the impact of CSR on organisations and their stakeholders and conclusion.

2. A Critical Review of the CSR Concept

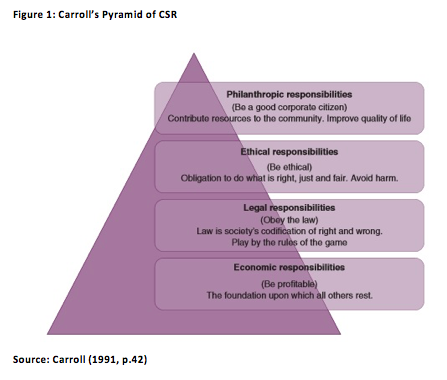

The fundamentals of the modern definition of CSR were established in Carroll’s (1991, p.42) Pyramid Model, according to which, business does not operate in isolation, and any company should take into account its impact on the employees, society and environment (Nalband and Al Kelabi, 2014, p.237). This framework considers economic responsibilities as the most important element that firms should focus on (Kaman, 2015, p.7). In turn, philanthropic responsibilities are viewed as the least important.

Although this model provides the reader with the basic idea of CSR, it ignores elements such as beliefs, values and assumptions (Nalband and Al Kelabi, 2014, p.237). Furthermore, it does not address how to identify the environmental issues, which is another limitation (Kaman, 2015, p.7).

Companies’ decision to implement CSR goes far beyond statutory and compliance requirements and creates additional social and economic value (Fonseca et al., 2016, p.155). Hence, it is possible to explain the CSR concept with the help of the stakeholder theory. As noted by Hamidu et al. (2015, p.89), the main reason why most companies take CSR activities and invest in CSR programmes is to satisfy their stakeholders, as they represent a group that has an indirect impact on the achievement of their corporate goals and objectives. Under the stakeholder perspective on CSR, managers are supposed to implement the right techniques and policies to ensure that the social responsibilities are fulfilled (Sheehy, 2015, p.628). The most important factor that has a considerable impact on organisational involvement in CSR activities is organisational governance (Fonseca et al., 2016, p.155). At the same time, some researchers argue that CSR can be used as a marketing instrument to make firms appear greener than they actually are (Brandt and Georgiou, 2016, p.7; Brandt and Georgiou, 2016, p.58).

The stakeholder approach is widely used as a strategic tool in business decision-making (Servaes and Tamayo, 2013, p.1045). The findings of Hamidu et al. (2015, p.89) are consistent with the observations of Brandt and Georgiou (2016, p.7) who explained that the main point of the stakeholder approach was not only to take into consideration the interests of society and taking responsibility. The researchers also underlined the importance of understanding the relationships that occurred within the company (e.g. between its managers and shareholders and employees) (Brandt and Georgiou, 2016, p.7). Employees are commonly viewed as an important stakeholder group, the interests and needs of which should be considered by the organisation to ensure the achievement of its strategic goals (Nalband and Al Kelabi, 2014, p.237). In their study, Fonseca et al. (2016, p.154) found that there was a strong relationship between organisational competitive advantage and organisational stakeholders’ satisfaction, which had made enterprises more focused on delivering value for their stakeholders. However, the stakeholder theory should not be perceived as an underlying concept of CSR.

Alternative to the stakeholder theory, the shareholder theory implies that the only true purpose of any company is to maximise its profit as well as the profit and welfare of its shareholders and owners (Brandt and Georgiou, 2016, p.37). This statement is in keeping with Fonseca et al. (2016, p.147) who also argued that organisations contributed to society by paying taxes and creating new jobs. At the same time, firms that are focused only on the maximisation of their shareholders’ profit create a negative effect on stakeholders, which consequently affects the overall organisational performance and diminishes organisational reputation (Brandt and Georgiou, 2016, p.37). As greater stakeholder satisfaction is considered to have a positive impact on the growth and success of organisations, the management must always tend to find a balance between stakeholders and shareholders and achieve the highest possible economic results (Fonseca et al., 2016, p.147).

CSR may be approached as a management initiative that tends to improve organisational performance (Sheehy, 2015, p.628). Thus, managers need to identify which CSR investments provide the highest value. Jonikas (2014, p.190) developed a conceptual model, which enabled managers to measure the value created through CSR and make adjustments if needed, in the cases when the CSR costs were higher than the value created. According to this theoretical framework, CSR activities are focused on the achievement of three major objectives. The company-related objective includes financial and marketing goals, while the stakeholders-related objective is concerned with the interests of employees, customers, suppliers and business partners (Nalband and Al Kelabi, 2014, p.237). Finally, the society-related objective covers the issues associated with the environment, society and government (Jonikas, 2014, p.192). Although this framework outlines certain financial goals and metrics, it does not take into account the welfare of owners and shareholders, which can be viewed as its limitation.

The main advantage of Jonikas’ (2014, p.190) model is that it covers both the stakeholder and shareholder theories. The factors included in this framework are consistent with the performance measures for the multiple stakeholder’s perspective presented by Harrison and Wicks (2013, p.115). An interesting issue was identified by the observations of the researchers who stated that stakeholders might not always be friendly and open for cooperation and there might be some conflicts between organisations and their stakeholders (Harrison and Wicks, 2013, p.117). This issue should get more attention and firms should search for ways to overcome potential problems with stakeholders. The findings of Jonikas (2014, p.192) are consistent with the observations of Servaes and Tamayo (2013, p.1045) who confirmed that CSR activities were positively related to a company’s value, but only under certain circumstances (e.g. customer awareness of a firm’s CSR activities must be high in order to create CSR value through customers as part of stakeholders and CSR activities must be in accordance with this company’s reputation). Not all stakeholders are important for a particular enterprise, so managers should focus only on stakeholder groups that create value and increase CSR investments in those areas (Jonikas, 2014, p.192).

In addition to its stakeholders and shareholders, organisations also tend to invest in CSR to achieve better financial performance (Lin et al., 2015, p.8292). The relationship between CSR and financial performance, including industry type as a moderator and intellectual capital as a mediator, is presented as follows.

The industry type of the corporation defines the level of CSR, taking into account ethical, legal and economic responsibilities (Omran and Ramdhony, 2015, p.40). The model shows that CSR indirectly influences financial performance through enhancing the intellectual capital (Lin et al., 2015, p.8293). The contribution of this integrated framework was the inclusion of the industry type variable as a moderator, as a unique approach that provided a better understanding of the importance of CSR for the company’s financial performance (Kaman, 2015, p.7). In addition, Lin et al. (2015, p.8306) identified that CSR had a direct effect on financial performance. However, this effect varies depending on a particular industry type, meaning the generalisability of this model to all industries is questionable.

The direct impact of CSR on financial performance is very high in environmentally sensitive industries (e.g. oil and gas extraction, mining and plastic and rubber products manufacturing), while it remains significantly low in environmentally non-sensitive industries (e.g. apparel manufacturing and banking sector) (Prutina, 2016, p.227; Supanti et al., 2014, p.24; Shen and Benson, 2016, p.1723). Hence, the investments in CSR activities within companies that operate in environmentally sensitive industries increase the level of financial performance, while firms from environmentally non-sensitive industries have a negative effect from CSR investments, as they are not perceived by their stakeholders to be affected by the corporative goals and objectives (Lin et al., 2015, p.8306). One of the main limitations of this framework is that is does not contain any sub-elements as well as intellectual capital components. Making this theoretical framework more detailed would provide a more sophisticated investigation of their relationship with the financial performance (Lin et al., 2015, p.8307).

3. The Impact of CSR on Organisations and Their Stakeholders

The CSR activities of a company affect its stakeholders in different ways and intensity. For example, employees as one of the most important stakeholders are highly affected by their employer’s CSR activities in marketing, which shape their mind-set, motivation and lead to deeper commitment to achieving organisational goals and objectives (Makasi et al., 2014, p.2600). In addition, CSR investments in marketing have a significant impact on external stakeholders such as consumers and their brand awareness (Kaman, 2015, p.7). In addition, consumers who identify themselves with a company’s brand are more likely to make a purchase decision and become more loyal to this brand (Chovanova et al., 2015, p.619). Hence, the level of a firm’s CSR investments in marketing defines its corporate image and position in the society. At the same time, some companies tend to use CSR as a propaganda instrument to promote the perception that their goods, services and policies are environmentally friendly (Makasi et al., 2014, p.2600).

Makasi et al. (2014, p.2601) carried out a quantitative study to identify the strategic CSR factors that influenced organisations. 15 out of 20 respondents surveyed by the researchers confirmed the hypothesis that CSR activities improved corporate image and enhanced employees’ morale (Makasi, 2014, p.2604). These findings have narrowed the gap related to not addressing environmental issues affecting CSR. The produced outcomes are in keeping with (Supanti et al., 2014, p.6) who also argued that CSR programmes could contribute to a firm’s brand positioning and corporate reputation. It should be critically remarked, however, that the validity and reliability of Makasi’s et al. (2014, p.2601) empirical results is questioned because of the small sample size.

In the findings of Prutina (2016, p.227), a positive relationship between CSR and organisational commitment was confirmed. Two components, namely CSR values and employee engagement in CSR, were identified as the mediators of this relationship (Prutina, 2016, p.227). It must be noted, however, that CSR had a significant impact on employees only when the CSR values component was included. Considering these outcomes, it is relevant to state that corporate social responsibility influences commitment only through values. As noted by Makasi et al., (2014, p.2597), employees’ participation and engagement in CSR positively influences their motivation and willingness to perform their tasks. Similar findings were produced by Prutina (2016, p.240) who observed the indirect effect of CSR on employees, customers and social and non-social stakeholders though the two mediator components, namely employee engagement in CSR and CSR values. Although the researchers managed to establish the link between CSR and employee commitment, their study suffered from the lack of generalisability (Prutina, 2016, p.240). The point is that the quantitative research project provided evidence of CSR only from Anglo-Saxon and Continental European counties.

Prutina’s empirical results (2016, p.240) are consistent with the observations of Supanti et al. (2014, p.21) who identified that CSR engagement was used as a tool to develop employee engagement and improve the overall organisational performance. The model developed for Supanti’s et al. (2014, p.21) study included three elements as mediators for employee engagement, namely positive emotions, social capital and task related skills. The empirical outcomes produced by the researchers are in keeping with Kim’s et al. (2013, p.696) observations. Similar to Supanti et al. (2014, p.21), Kim et al. (2013, p.696) argued social capital had a strong impact on employees’ knowledge-sharing that resulted in better relationships and employee outcomes (e.g. satisfaction, motivation and commitment). However, both models might have included cost-benefit analysis based on CSR engagement, which would provide opportunities to identify additional organisational effects of CSR activities (Supanti et al., 2014, p.27).

In turn, Hur et al. (2014, p.82) confirmed that CSR activities had a direct positive effect on corporate reputation and corporate brand credibility. The corporate brand credibility served as a mediator in the relationship between CSR and corporate reputation and corporate brand equity (Hur et al., 2014, p.82). This research provides directions to CSR managers who tend to increase the quality of their company’s marketing performance. Being more precise, Hur’s et al. (2014, p.83) findings suggest that by expanding investments in marketing areas and building a better consumer perspective of marketing performance, firms are able to achieve higher levels of brand credibility, brand equity and reputation. At the same time, the researchers did not distinguish between various CSR dimensions, which can be viewed as a limitation. In order to generalise the results gained by this research, further studies are required to determine different effects of CSR dimensions such as economic, legal, ethical and philanthropic on corporate marketing performance and identify how these dimensions influence corporate brand outcomes (Brandt and Georgiou, 2016, p.65).

The relationship between CSR reputation and perceived community value and trust as a mediator was established in the study by Chomvilailuk and Butcher (2016, p.168). This investigation was the first to present perceived community value as a variable used to measure new customer perceptions and as an organisational effect of CSR incentives (Chomvilailuk and Butcher, 2016, p.168). In the same vein, Kaman (2015, p.5) argued that consumers more actively purchased from organisations whose CSR activities were perceived to have greater value for local communities. At the same time, Chomvilailuk and Butcher’s (2016, p.168) model can be viewed as excessively complex for understanding. The level of complexity could be decreased by including additional elements such as stakeholder awareness, recognition and community value (Makasi et al., 2014, p.2597).

4. Conclusion

It can be concluded that CSR is a complex concept that allows organisations to address their business objectives, fulfil stakeholders and shareholders’ needs and contribute to the development of local communities and a broader society (Nalband and Al Kelabi, 2014, p.237). CSR helps companies further develop the commitment and loyalty of their customers and employees as well as to increase sales and engage in new business activities (Omran and Ramdhony, 2015, p.40). Nonetheless, the concept of corporate social responsibility requires further research in order to more properly explore its impact on companies and their stakeholders (Hur et al., 2014, p.82). For example, some organisations may use CSR as a greenwashing tool to promote their brand image and appear greener than they actually are (Brandt and Georgiou, 2016, p.7). In this case, CSR can negatively affect these firms’ stakeholders in the long-term perspective.

References

Brandt, F. and Georgiou, K. (2016) Shareholders vs. Stakeholders Capitalism, Philadelphia: University of Pennsylvania Law School.

Carroll, A. B. (1991) “The Pyramid of Corporate Social Responsibility: Toward a Moral Management of Organizational Stakeholders”, Business Horizons, 34 (4), pp. 39-48.

Chomvilailuk, R. and Butcher, K. (2016) “Evaluating the Effect of Corporate Social Responsibility Communication on Mobile Telephone Customers”, Journal of Retailing and Consumer Services, 33 (1), pp. 164-170.

Chovanova, H., Korshunov, A. and Bachanova, D. (2015) “Impact of Brand on Consumer Behavior”, Procedia Economics and Finance, 34 (1), pp. 615-621.

Fonseca, L., Ramos, A., Rosa, A., Braga, A. and Sampaio, P. (2016) “Stakeholders Satisfaction and Sustainable Success”, International Journal of Industrial and Systems Engineering, 24 (2), pp. 144-157.

Hamidu, A., Haron, H. and Amran, A. (2015) “Corporate Social Responsibility: A Review on Definitions, Core Characteristics and Theoretical Perspectives”, Mediterranean Journal of Social Sciences, 6 (4), pp. 83-95.

Harrison, J. and Wicks, A. (2013) “Stakeholder Theory, Value, and Firm Performance”, Business Ethics Quarterly, 23 (1), pp. 97-124.

Hur, W., Kim, H. and Woo, J. (2014) “How CSR Leads to Corporate Brand Equity: Mediating Mechanisms of Corporate Brand Credibility and Reputation”, Journal of Business Ethics, 125 (1), pp. 75-86.

Jonikas, D. (2014) “Value Created through CSR Measurement Possibilities”, Procedia - Social and Behavioral Sciences, 156 (1), pp. 189-193.

Kaman, Z. (2015) “Corporate Social Responsibility (CSR) Models: An Approach to Environmental Perspective”, International Research Journal of Engineering and Technology (IRJET), 2 (7), pp. 5-9.

Kim, T., Lee, G., Paek, S. and Lee, S. (2013) “Social capital, knowledge sharing and organizational performance”, International Journal of Contemporary Hospitality Management, 25 (5), pp. 683-704.

Lin, C., Chang, R. and Dang, V. (2015) “An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance”, Sustainability Journal, 7 (1), pp. 8292-8311.

Makasi, A., Govender, K. and Munyoro, T. (2014) “The Effects of Corporate Social Responsibility (CSR) on Corporate Brand Positioning”, Mediterranean Journal of Social Sciences, 5 (20), pp. 2597-2607.

Nalband, A. and Al Kelabi, S. (2014) “Redesigning Carroll’s CSR Pyramid Model”, Journal of Advanced Management Science, 2 (3), pp. 236-239.

Omran, M. and Ramdhony, D. (2015) “Theoretical Perspectives on Corporate Social Responsibility Disclosure: A Critical Review”, International Journal of Accounting and Financial Reporting, 5 (2), pp. 38-55.

Prutina, Z. (2016) “The Effects of Corporate Social Responsibility on Organisational Commitment”, Management Journal, 21 (1), pp. 227-248.

Servaes, H. and Tamayo, A. (2013) “The Impact of Corporate Social Responsibility on Firm Value: The Role of Customer Awareness”, Management Science, 59 (5), pp. 1045-1061.

Sheehy, B. (2015) “Defining CSR: Problems and Solutions”, Journal of Business Ethics, 131 (3), pp. 625-648.

Shen, J. and Benson, J. (2016) “When CSR Is a Social Norm: How Socially Responsible Human Resource Management Affects Employee Work Behaviour”, Journal of Management, 42 (6), pp. 1723-1746.

Supanti, D., Butcher, K. and Fredline, L. (2014) “Enhancing the employer-employee relationship through corporate social responsibility (CSR) engagement”, International Journal of Contemporary Hospitality Management, 27 (7), pp. 1-34.